Drawing on our experience in the mortgage and solar industries, we realized that there had to be a better way to enable homeowners to add solar to their home, increase their home value, and participate in the monthly savings.

Solar was assigned no value.

Appraisers assigned a value of $0 and the solar industry marketed it with a value of cost. Neither approach was realistic.

Mortgage Lenders wouldn't lend against it.

We created a way to solve this challenge. First was enabling market value for solar in 2009. The U.S. Dept. of Energy's Sandia National Laboratories reached out, and in 2012 - PvValue was officially launched for appraisers and mortgage lenders.

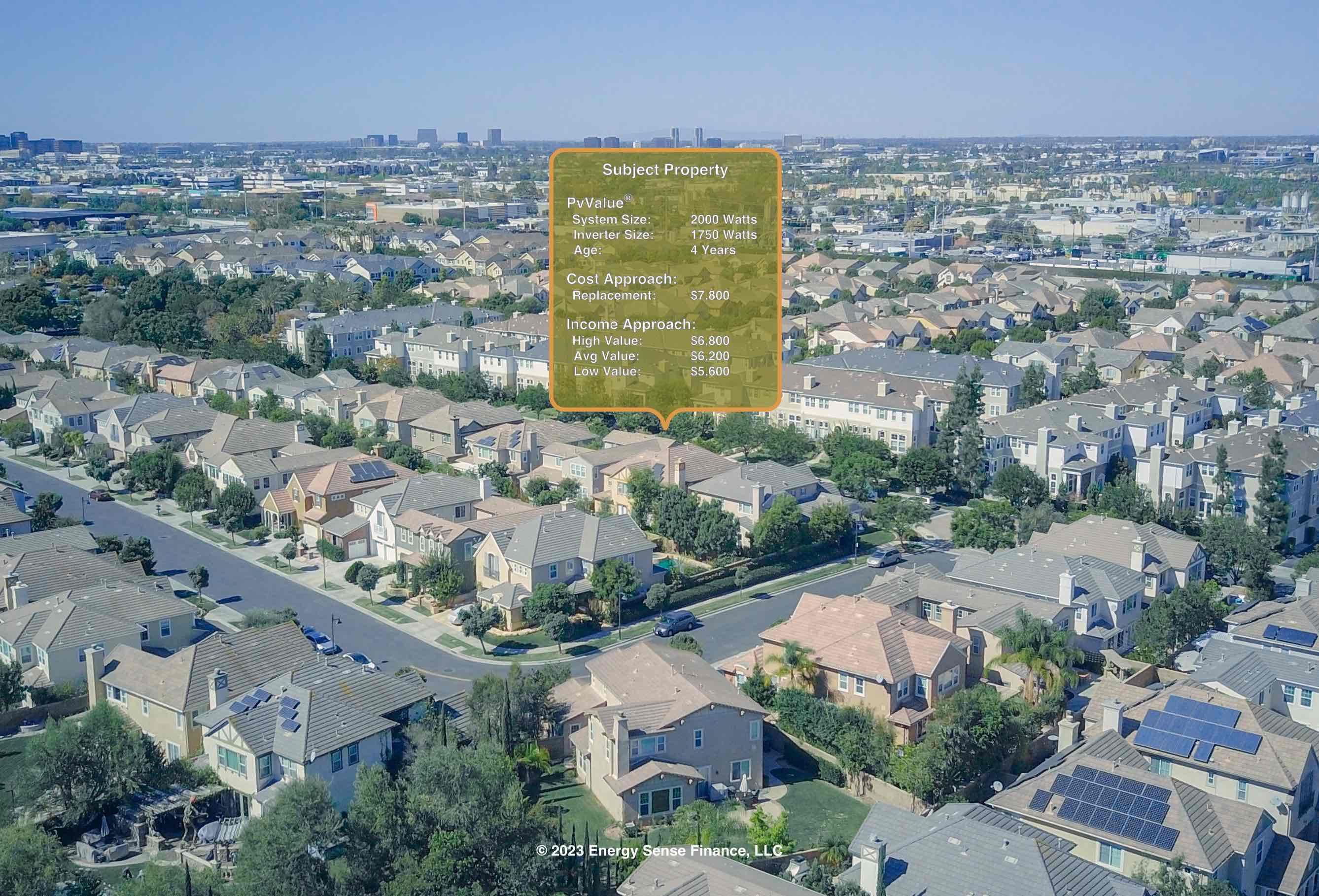

PvValue enables licensed real estate appraisers to value solar in accordance with the Uniform Standards of Professional Appraisal Practice (USPAP).

We then led the way by working with the Appraisal Institute (AI) and Government Sponsored Enterprises (GSE's) to enable solar value in the mortgage with PvValue. This also involved creating a 2-day course with the AI, to train appraisers and mortgage underwriters in valuing solar with PvValue.

Solar finance products were designed as short-term, solutions.

The next step was financing. Solar financing in the U.S. is costly! In fact the U.S. has some of the most expensive solar financing among G-20 countries. Its so costly that it requires a sales rep to convince the homeowner to signup. Those additional expenses for sales and finance can double the cost of solar to the homeowner and reduce the potential monthly savings to near $0.

It is estimated that only 15% to 20% of new residential solar installations add contributory value to the home value. If there is a third party owner (TPO) involved such as with a PPA or Leased system, then the ownership of the system and the market value is transferred to the TPO. If there is a solar loan and it classifies the solar as personal property or allows solar equipment removal for non-payment, then there is no contributory value for solar in the market value of the home.

The result after nearly 15 years of high-cost, solar finance & sales solutions, is a 5% adoption rate for solar among U.S. homeowners. Compare that to fellow G-20 member Australia, where the elimination of almost all financing and sales costs has resulted in the solar adoption rate among homeowners nearing 35% - 7X higher than the U.S.!

Think the Aussies are an outlier? Other G-20 members are also leading the U.S. in residential solar adoption rates like Italy at 23% or Germany at 11%. Even non G-20 members like the Netherlands are leading the U.S. with an adoption rate of 16%.

High-cost, solar finance & sales solutions have run their course. They've held back the adoption rate for solar, and they no longer match up with homeowner expectations for what solar financing should be.

Long-term solution needed to scale to tens of millions of homeowners.

We proposed an automated, low-cost, consumer-friendly, regulatory-type framework with Sandia National Laboratories in 2013. One that would enable the valuation and financing of new solar installations at scale - no sales reps needed with this method as the solar sells itself.

After over a decade of SunShot funded R&D, we are ready to enable homeowners to install solar that they own directly, as a real property fixture, without expensive financing and sales costs. Solar that adds real value to their largest financial investment.

Our success in scaling PvValue to a nearly 25% adoption rate among our core user - real estate appraisers - a 5X over the 5% residential adoption rate for solar - shows that our low-cost, regulatory-type framework for solar valuation & finance is scalable to 10's of millions of homeowners in the near term.

Its time for transparency in solar finance. A new method of financing solar that enables homeowners to keep their monthly savings, and stop sending it to Wall Street Investors & Silicon Valley Bankers.

We're run like a social capital backed company.

If you are a mortgage lender committed to responsible mortgage finance and are ready to add value for your borrowers -

PvValue®

Created in 2009 to enable the addition of solar value in the mortgage origination process.

PvValue® was launched in 2012 with Sandia National Laboratories, has been featured at multiple White House roundtables on mortgage finance, and is used by Appraisers and Mortgage Underwriters in all 50 States + P.R. & D.C.

Frequently Asked Questions

PvValue

Solar Finance